For offshore companies operating internationally, a BVI Certificate of Incumbency is one of the most frequently requested corporate verification documents.

Financial institutions, regulators, investors, and transaction counterparties routinely require an updated incumbency certificate before onboarding a British Virgin Islands entity or approving corporate transactions.

A practical compliance question therefore arises:

Can a BVI Certificate of Incumbency be certified by a UK practising solicitor and apostilled by the UK Foreign, Commonwealth & Development Office (FCDO), rather than obtaining authentication directly in the British Virgin Islands?

In commercial practice, the UK solicitor certification + FCDO apostille route is widely used — particularly where transaction speed, cost efficiency, and document logistics are commercially critical.

This guide explains how the UK certification route works, when it is accepted internationally, and when BVI-origin authentication may still be required.

What Is a BVI Certificate of Incumbency?

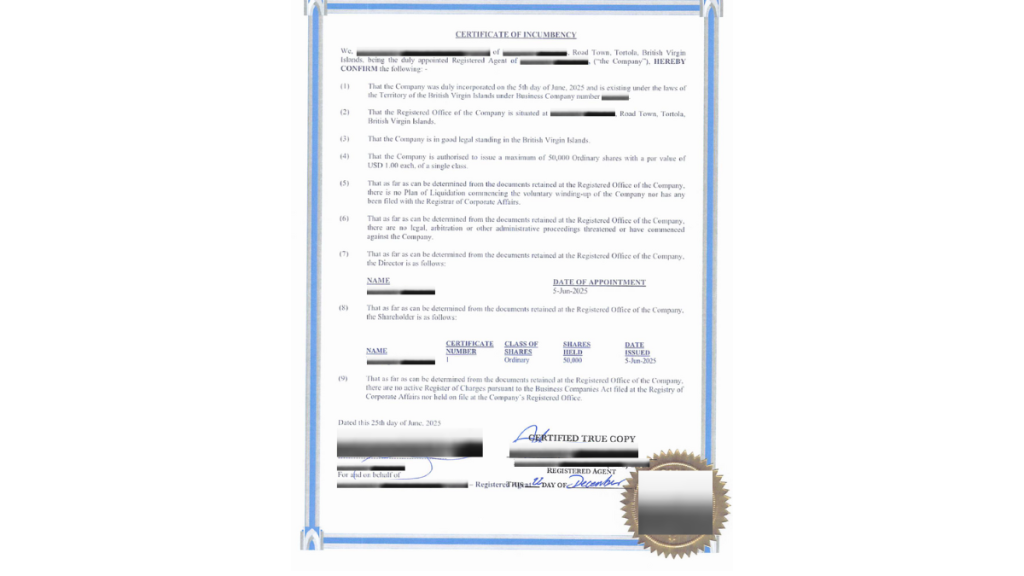

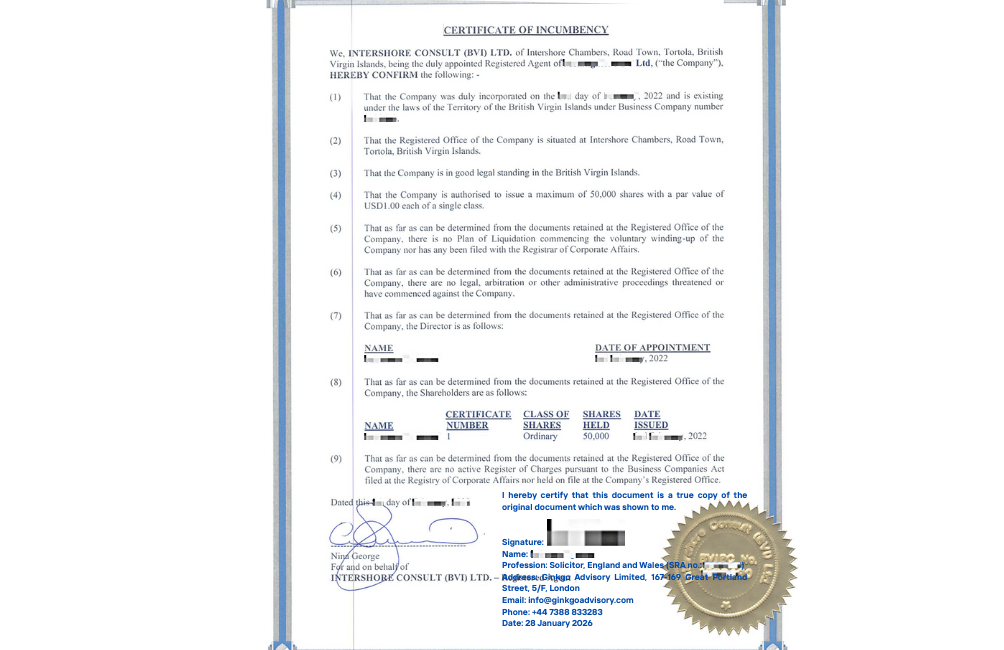

A BVI Certificate of Incumbency is a corporate confirmation document issued by a BVI Registered Agent or authorised corporate service provider.

It verifies the current corporate control and signing authority structure of a BVI company at the time of issuance.

A typical incumbency certificate confirms:

- Current directors

- Current shareholders and ownership structure

- Ultimate beneficial ownership (UBO) confirmation (in some cases)

- Authorised company signatories

- Company secretary (if appointed)

- Registered office details

- Corporate governance and authority confirmation

Unlike a Certificate of Incorporation or Certificate of Good Standing, an incumbency certificate is treated as a real-time corporate governance snapshot.

For international compliance teams, it is frequently used to confirm who has legal authority to bind the company.

Why Banks and Regulators Require BVI Incumbency Certificates

Incumbency certificates form a core part of global corporate due diligence frameworks under AML and KYC regulations.

Corporate Authority Verification

Banks must confirm which individuals are legally authorised to execute agreements, open accounts, or approve transactions.

Ownership Transparency and UBO Compliance

Financial regulators increasingly require disclosure of beneficial ownership structures under global anti-money laundering rules.

Corporate Governance Confirmation

The document confirms that the company remains properly structured and operational.

Transaction Risk Assessment

Investment firms, lenders, and counterparties rely on incumbency certificates to validate corporate counterparties before executing transactions.

Can a BVI Certificate of Incumbency Be Apostilled in the UK?

Short Answer — Yes, in Many Commercial Situations

A BVI incumbency certificate can often be legalised for international use through the following structure:

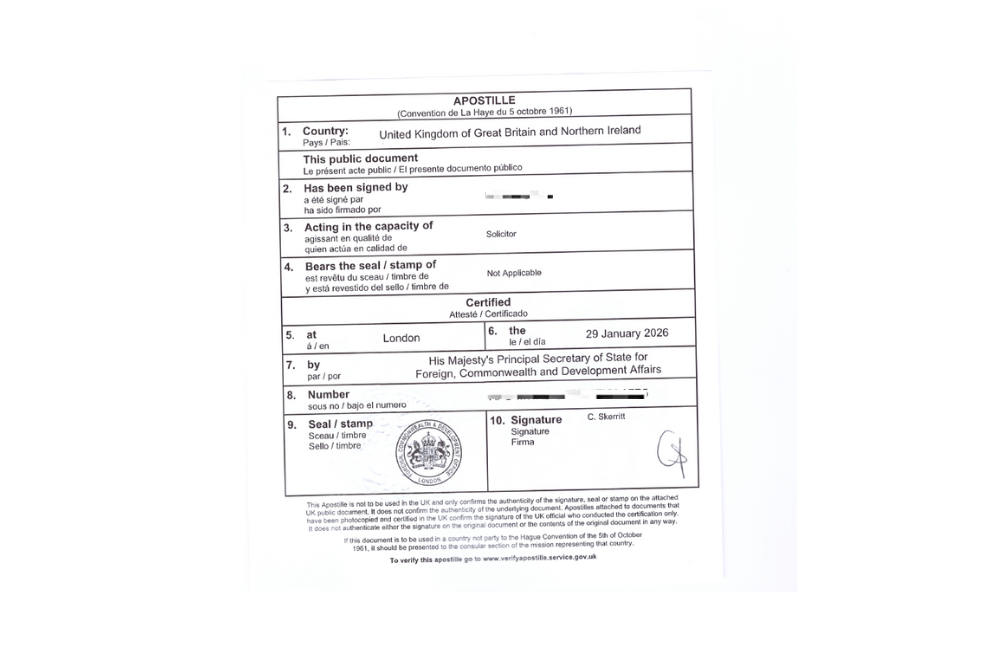

UK Solicitor Certification → UK FCDO Apostille

This route is commonly accepted where the receiving authority permits professionally certified corporate documents.

How the UK Solicitor Certification and Apostille Route Works

Step 1 — UK Solicitor Certification

A practising UK solicitor certifies:

- A certified true copy of the BVI incumbency certificate; or

- A certified copy of a BVI notarial corporate document

The solicitor confirms that the document copy corresponds with the original presented for verification.

Step 2 — UK FCDO Apostille

The UK Foreign, Commonwealth & Development Office issues an apostille verifying:

- Authenticity of the solicitor’s signature

- Professional standing of the solicitor

- Validity of the UK certification chain

Under Hague Apostille Convention rules, the apostille authenticates the UK certifying professional rather than the original BVI issuing authority.

Why Companies Frequently Use the UK Apostille Route

Over the past decade, the UK certification pathway has become widely adopted in offshore corporate transactions.

Faster Processing Timelines

Direct BVI authentication requires offshore notarisation, registered agent coordination, and international courier handling.

UK certification combined with FCDO apostille typically reduces turnaround time significantly.

Lower Transaction Administration Costs

The UK route often removes:

- Offshore notarisation stages

- Multi-jurisdiction authentication chains

- Additional courier logistics

Greater Transaction Certainty

Bank onboarding, financing transactions, and corporate restructurings are often highly time-sensitive.

UK apostille processing frequently allows companies to meet deal execution deadlines.

Common Uses of UK Apostilled BVI Incumbency Certificates

People regularly use UK solicitor-certified and apostilled incumbency certificates for:

- International corporate bank account opening

- Cross-border AML and KYC verification

- Corporate financing and lending transactions

- Shareholder and ownership verification

- Investment fund onboarding

- Mergers and acquisitions documentation

- Commercial regulatory filings

Do All Countries Accept UK Apostilled BVI Incumbency Certificates?

Acceptance varies depending on jurisdiction and filing purpose.

Based on practical transaction experience, UK solicitor-certified BVI corporate documents are frequently accepted for commercial and banking filings in jurisdictions such as China.

However, final acceptance always remains subject to the receiving authority’s evidential requirements.

When You May Require BVI Apostille

Certain regulatory environments require authentication originating directly from the British Virgin Islands.

This is more common in situations requiring higher evidential or notarial weight

In these circumstances, BVI notarisation and apostille processing may be mandatory.

Compliance Considerations Before Selecting the UK Apostille Route

An apostille confirms the authenticity of the certifying professional’s signature.

It does not guarantee automatic acceptance by foreign authorities.

Before selecting a legalisation pathway, companies should assess:

- Destination jurisdiction requirements

- Filing or transaction purpose

- Evidential weight required

- Transaction urgency

- Counterparty compliance risk tolerance

Choosing the correct certification structure is often a strategic compliance decision rather than a purely administrative one.

UK Solicitor Certification Requirements for BVI Incumbency Certificates

To certify an incumbency certificate, a UK practising solicitor typically requires:

- Original or verifiable corporate document

- Intended use of document (in certain compliance contexts)

Certification wording must comply with FCDO authentication standards.

How Ginkgo Advisory Supports BVI Incumbency Certification and Apostille

Ginkgo Advisory provides transaction-focused legalisation coordination for offshore corporate documentation.

UK Solicitor Certification and Apostille Coordination

We work with practising UK solicitors to arrange:

- Certified true copies of BVI incumbency certificates

- Certification of BVI corporate notarial documents

- Full FCDO apostille processing

- Translation and filing preparation

- Fast-track turnaround aligned with transaction deadlines

Full BVI Apostille and Offshore Legalisation Support

If you require BVI apostille, we coordinate:

- BVI notarial certification

- BVI apostille processing

- Registered agent liaison

- Offshore document retrieval

- International courier logistics

- Translation and regulatory filing preparation

Choosing the Most Efficient BVI Legalisation Strategy

Each cross-border corporate transaction carries different compliance expectations, evidential standards, and timing pressures.

Selecting the optimal legalisation structure involves balancing:

- Regulatory acceptance certainty

- Jurisdiction-specific evidential requirements

- Transaction efficiency

- Commercial risk management

Ginkgo Advisory assists corporate clients, investors, and professional advisors in evaluating regulatory requirements and transaction risks to determine the most efficient document legalisation pathway.

Contact Us

Address

167-169 Great Portland Street, 5/F, London