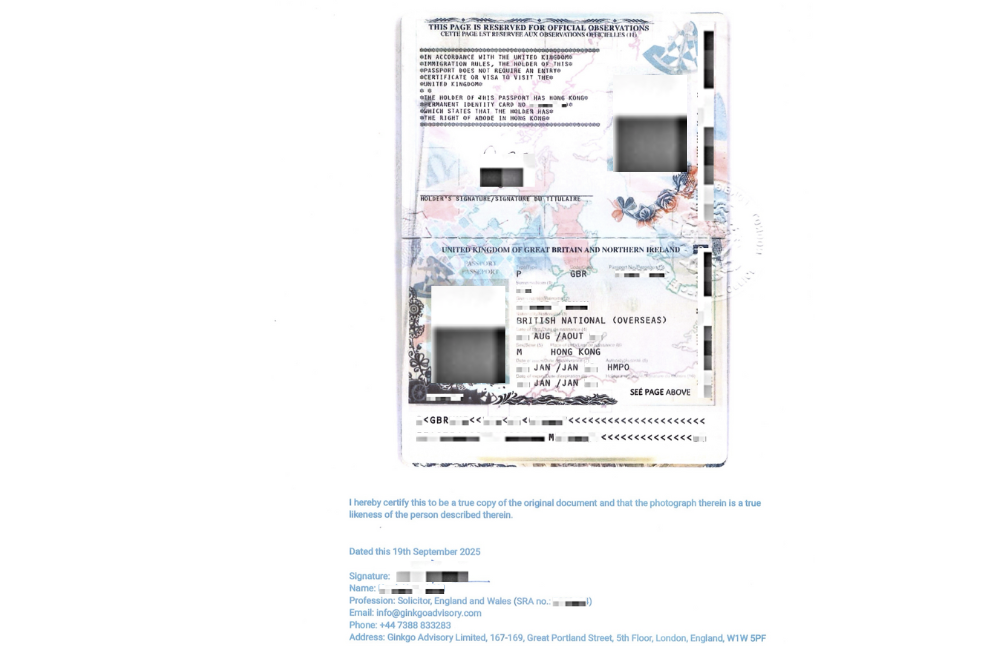

About the Author

Kwok is a practising solicitor based in London, admitted in England & Wales and regulated by the Solicitors Regulation Authority. He is registered with the Foreign, Commonwealth & Development Office and admitted in Hong Kong (non-practising). Kwok has worked as legal counsel and in-house solicitor across leading firms and corporations. He personally oversees every apostille and legalisation case at Ginkgo Advisory, ensuring consistency, accuracy, and end-to-end quality control.

Kwok Lam

Legal Consultant of Ginkgo Advisory

Opening an account with Barclays International, Barclays Bank, or other global financial institutions frequently requires clients to submit certified identification documents as part of KYC and AML compliance procedures.

For international clients, expats, high-net-worth individuals, and clients relocating to the UK, document certification is one of the most common reasons why applications to Barclays International or Barclays Bank are delayed or rejected.

This guide explains:

- What certified copies mean under Barclays and international banking compliance

- Barclays International KYC certification requirements

- How UK practising solicitors certify identity documents accepted by Barclays Bank

- Common compliance rejection risks

- How Ginkgo Advisory assists clients preparing documents for Barclays International onboarding

What Is a Certified Copy for Barclays International and Barclays Bank?

A certified copy is a photocopy of an original document that has been verified and formally confirmed by an UK practising solicitor as a true and accurate reproduction.

Both Barclays Bank and Barclays International require certified copies when clients cannot present original identification documents in person.

Certification confirms:

- The copy matches the original document

- The client presenting the document has been properly identified

This requirement forms part of:

- Barclays KYC verification procedures

- Global Anti-Money Laundering (AML) compliance

- International financial onboarding standards

Certified Copy vs Certified True Copy (Barclays Compliance Perspective)

Within Barclays International and Barclays Bank onboarding procedures, there is generally no legal distinction between:

- Certified copy

- Certified true copy

Both terms are used interchangeably across Barclays compliance manuals and international banking practice.

However, Barclays requires very specific certification wording.

Proof of Identity

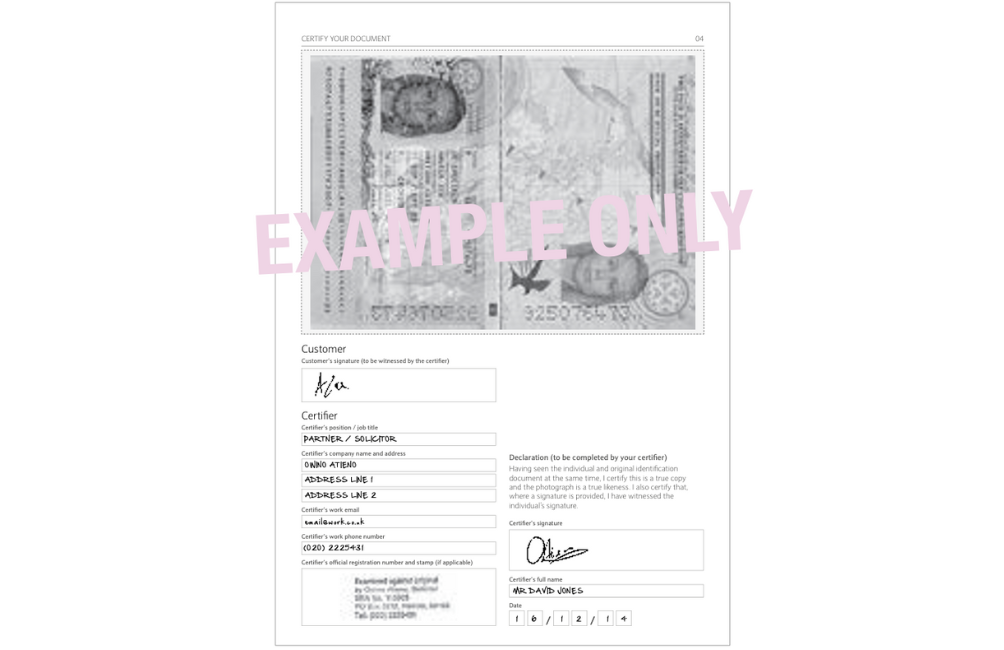

Barclays International typically requires certifiers to confirm:

I confirm that having seen the individual and the original identification document, this is a true copy and the photograph is a true likeness.

Proof of Address

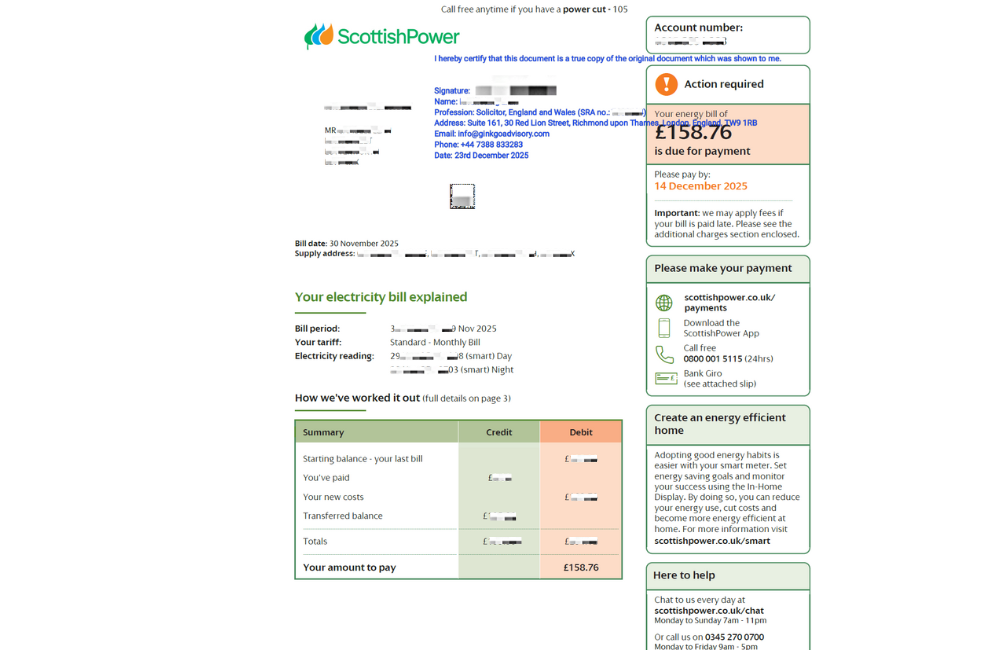

For address verification required by Barclays Bank:

I confirm that this is a true copy of the original document.

Incorrect or incomplete wording is one of the most common reasons Barclays rejects certified documents.

Why Barclays International Requires Certified Documents (KYC & AML Rules)

Like all global financial institutions, Barclays International must verify client identity and residential address under regulatory obligations.

These requirements help Barclays Bank confirm:

- Customer identity authenticity

- Residential address legitimacy

- Sanctions screening compliance

- Fraud prevention safeguards

- Source of funds and wealth risk controls

Failure to provide correctly certified documentation may result in Barclays delaying or declining account applications.

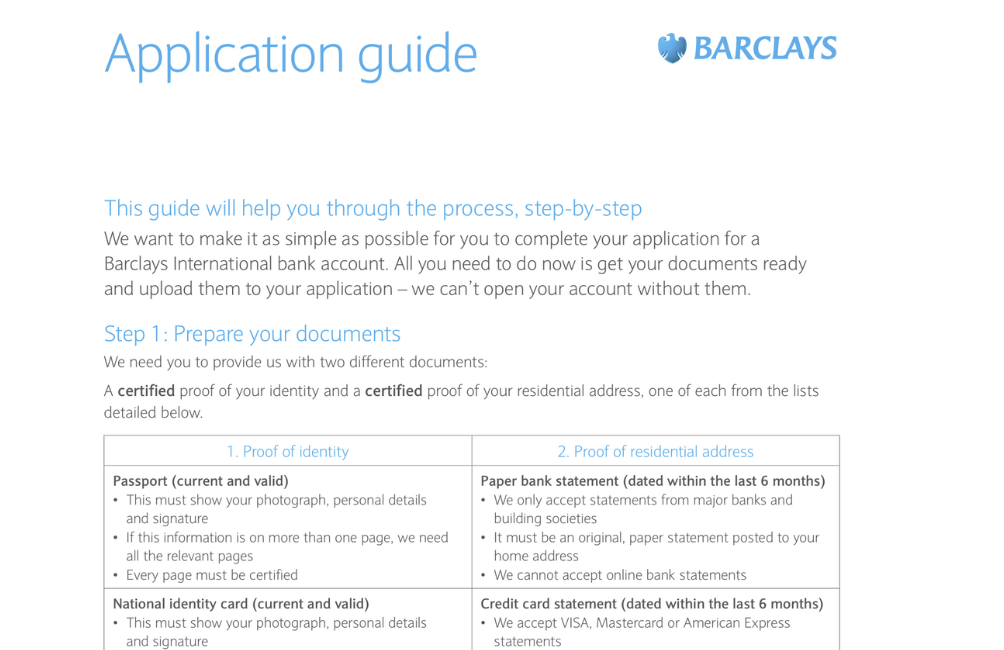

Barclays International Certified Document Requirements

Clients applying for accounts with Barclays International or Barclays Bank are usually required to submit:

Certified Proof of Identity Accepted by Barclays

Barclays commonly accepts:

- Valid passport

- National identity card

- Photocard driving licence

Barclays certification requirements include:

- All relevant pages must be certified

- Photograph and signature pages must be clearly visible

- Certifier must confirm identity likeness

- Certifier must confirm copy authenticity

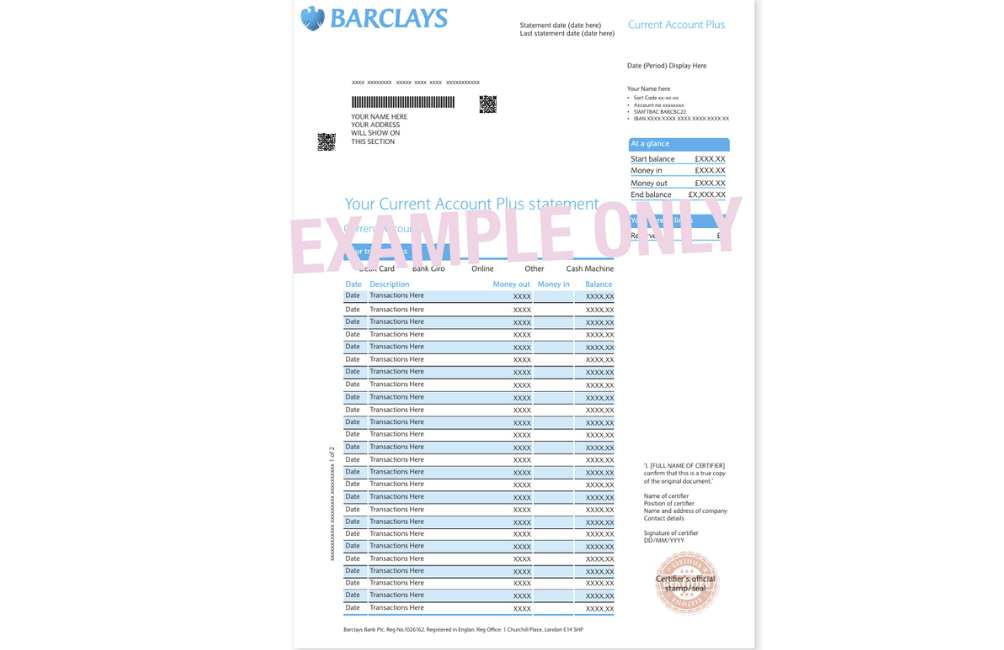

Certified Proof of Address Accepted by Barclays Bank

Barclays International typically accepts:

- Paper bank statements issued within 6 months

- Credit card statements from recognised providers

- Utility bills (gas, electricity, water, or landline only)

- Mortgage or home loan statements

Barclays usually requires:

- Original paper documents posted to residential address

- Full client name and address clearly displayed

- Certification on every relevant page

- Online statements often rejected

Who Can Certify Documents for Barclays International?

Barclays Bank and Barclays International usually accept certification from recognised professionals including:

Regulated Legal Professionals

- UK practising solicitors

- Notaries public

- Barristers

Why Barclays International Frequently Accepts UK Practising Solicitor Certification

Certification completed by a UK practising solicitor is widely recognised by Barclays Bank because:

- UK solicitors are regulated by the Solicitors Regulation Authority (SRA)

- Barclays compliance teams recognise UK solicitor certification credibility

- Frequently accepted for cross-border banking onboarding

This is especially important for Barclays International clients opening:

- Offshore or international investment accounts

- Multi-currency wealth management accounts

- International mortgage financing

- Accounts involving overseas beneficial owners

Common Reasons Barclays Rejects Certified Documents

Compliance teams at Barclays International frequently reject certification due to:

Incorrect Certification Wording

Barclays requires precise certification declarations.

Missing Certifier Registration Information

Barclays requires professional licence or registration verification.

Incomplete Certification

Barclays requires every relevant page to be certified.

Illegible Document Copies

Barclays requires clear visibility of photographs and personal data.

Online Address Proof

Barclays often requires paper statements posted to the client.

Expired Address Evidence

Barclays typically requires address proof issued within six months.

Who Typically Requires Certification When Opening Barclays International Accounts?

Certification is commonly required by:

- International wealth management clients using Barclays International

- Expats maintaining accounts with Barclays Bank

- Clients relocating to the UK using Barclays International onboarding

- Offshore corporate beneficial owners banking with Barclays

- Cross-border investors financing UK property through Barclays

Barclays International: Who They Serve

Barclays International focuses on supporting clients who operate across multiple jurisdictions.

International Clients

Barclays International supports wealth diversification, foreign exchange, and UK property financing.

Expats

Barclays Bank provides continuity of banking for clients working or living overseas.

Clients Moving to the UK

Barclays International allows account setup before relocation, helping clients integrate financially upon arrival.

Barclays International Eligibility Thresholds

Typical Barclays International account eligibility includes:

- Minimum £100,000 savings or investment relationship

- £250,000 threshold for relationship management services

Barclays services commonly include:

- Multi-currency accounts

- International savings structures

- Investment portfolio management

- Pre-arrival mortgage arrangements

- Overseas income mortgage assessments

How Ginkgo Advisory Helps Clients Prepare Barclays Certification Requirements

Ginkgo Advisory regularly supports international clients preparing UK solicitor certified copy for Barclays International and Barclays Bank onboarding.

We assist clients with:

- Remote / online passport certification

- Remote / online address proof certification

- Power of Attorney certification

- Remote / online corporate document certification for Barclays onboarding

Contact Us

Address

167-169 Great Portland Street, 5/F, London