If Barclays (including Barclays Bank and Barclays International) has closed or restricted your personal account because it was inactive, you can usually claim the money back — but your payout will not be processed until Barclays can verify identity and authority.

The #1 reason claims get delayed is not the account details. It’s missing or incorrectly certified documents.

This guide explains, in plain English, what Barclays expects, how to avoid common rejections, and how Ginkgo Advisory can help with remote UK practising solicitor certification (“certified true copy / certified copy”) so your submission is bank-ready.

What this Barclays claim process covers

You can use this Barclays process to claim money from personal accounts that were closed or restricted because they were inactive.

You will need to submit:

- the completed claim form, and

- certified copies of the documents that verify the account holder (or verify that you’re authorised to act for them).

The “must-do” requirement: certified copies (Barclays will not send money without them)

Barclays is clear: they can’t send your money if you don’t send certified copies of the required documents.

Who can certify your documents?

Barclays accepts certification by:

- Barclays staff

- a professional like a solicitor, doctor, or accountant

- an embassy consular or high commission official

- if you’re in the EU, a notary public also works

For many clients (especially overseas), using a UK practising solicitor is the most straightforward, bank-recognised option.

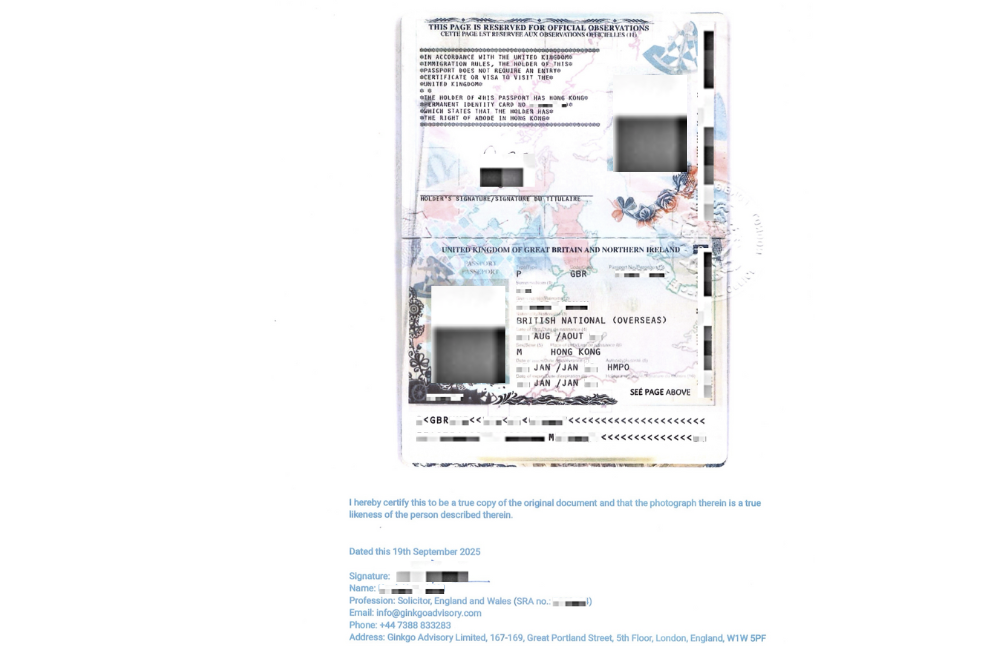

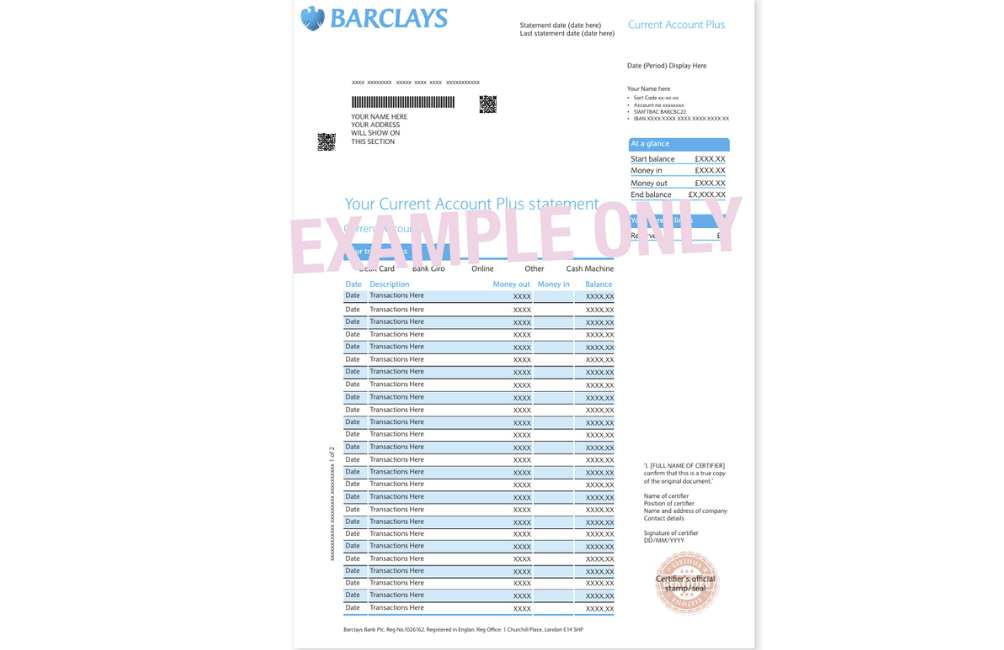

Exact certification wording Barclays expects (don’t improvise)

Your certified copies should include the certification statement and certifier details in this format:

“I certify that this is a true copy of the original.”

Plus:

- Signature

- Date

- Name

- Position

- Company or organisation

If any one of these elements is missing, banks often treat the copy as not properly certified.

Documents you must send (most common Barclays claim)

All claims: two separate certified documents

Barclays requires two different certified documents:

- One that proves your identity (photo ID), and

- A different one that proves your address

You can use a driving licence as one of these, but not both.

1) Proof of identity (photo ID)

Send a certified copy of a photo ID in your name, such as:

- Passport

- Driving licence

- UK Armed Forces identity card

2) Proof of address (must be recent)

Send a certified copy of a document showing your current full address and dated within the last 3 months, such as:

- Bank statement

- Credit card statement

- Utility bill (with limitations — see below)

Barclays also notes they can’t accept online-only bank statements or documents, and they can’t accept water utility bills.

They say you can use an HMRC letter dated within the last 12 months.

Extra rules depending on your situation (Barclays-specific)

Joint accounts

If you’re claiming money from a joint account, Barclays requires photo ID for all account holders (certified).

Claiming on behalf of someone else (power of attorney / authority letter)

You can claim for someone else if you have:

- a power of attorney, or

- a signed letter of authorisation from the account holder

In addition to your own ID + address proof, you must also provide certified copies of:

- the account holder’s photo ID

- the account holder’s proof of address (recent)

- the POA or authorisation letter

And again: the account holder’s driving licence can be used for either identity or address proof, but not both.

Name change

If the account holder’s name changed since the account was held, you’ll need a certified copy of an official name change document (e.g., marriage certificate or deed poll).

Foreign currency accounts: reactivate or close

If the restricted account is a foreign currency account, Barclays may ask whether you want to reactivate it or close it.

If you want to reactivate, Barclays says you’ll need a Barclays sterling account in the same name and provide those details; otherwise you’ll need to close the currency account and receive a cheque for the closing balance.

Payments: UK transfer, international transfer, or cheque

Barclays provides payment sections for:

- UK bank transfer

- Non-UK bank transfer (IBAN / SWIFT details)

- Cheque (sent in sterling, with delivery time depending on local post)

They note bank transfer is typically the fastest and safest method.

Signatures: print and sign (no e-signatures)

Barclays requires you to print the form to sign it and says they can’t accept electronic signatures.

If it’s a joint account, all account holders must sign.

Translation requirement (if documents aren’t in English)

If your certified documents aren’t in English, you must also send a certified English translation.

Don’t send originals

Barclays says: Please don’t send any original documents, as they’re unable to return them.

How Ginkgo Advisory helps (Remote UK Practising Solicitor Certification)

Most people get stuck on one step: certified copies. Visiting a branch or finding a local certifier can be slow — especially if you’re overseas.

Ginkgo Advisory offers remote certification by a UK practising solicitor, designed for Barclays claim packs and bank-grade compliance submissions.

Our service: remote certified true copies (bank-ready)

We help you produce:

- Certified true copy of passport / driving licence

- Certified copy of proof of address

- Certified copies for:

- joint holders (multiple IDs)

- POA / authorisation scenarios

- name change documents

- Where needed: guidance on certified English translation workflow

Why remote certification matters for Barclays claims

- You don’t need to travel to a UK branch or solicitor’s office

- Your certified copies are produced in the required statement + certifier detail format

- You avoid common “rejected certification” loops that delay payout

(As always, acceptance depends on Barclays’ current processing rules and your specific circumstances; we align your pack to the requirements shown in Barclays’ instructions.)

Barclays claim checklist

Before you post your pack, confirm you have:

- ✅ Completed claim form in English

- ✅ Certified copy of photo ID (you)

- ✅ Certified copy of proof of address (you) — within last 3 months, not online-only, not water bill

- ✅ If joint account: certified photo ID for each account holder

- ✅ If claiming for someone else: certified copies of account holder’s ID + address + POA/authority letter

- ✅ If name change: certified copy of marriage certificate / deed poll

- ✅ Certified English translations (if any document isn’t in English)

- ✅ Printed signatures (no e-signature; all joint holders sign)

And remember: don’t send originals.

Contact Us

Address

167-169 Great Portland Street, 5/F, London