When opening a bank account with HSBC, completing compliance checks, or verifying ownership of a company, you may be asked to provide a certified copy (or certified true copy) of your documents.

This is a standard requirement for:

- Bank account opening (including HSBC Safeguard reviews)

- KYC (Know Your Customer) checks

- AML (Anti-Money Laundering) verification

- UBO (Ultimate Beneficial Owner) due diligence

- Immigration or cross-border applications

Understanding how certification works helps avoid delays and document rejection.

What Is a Certified Copy?

A certified copy is a copy of an original document that has been formally confirmed by an authorised professional as accurate.

For photo ID documents (such as passports), certification normally confirms:

- The copy matches the original document

- The photograph is a true likeness of the individual

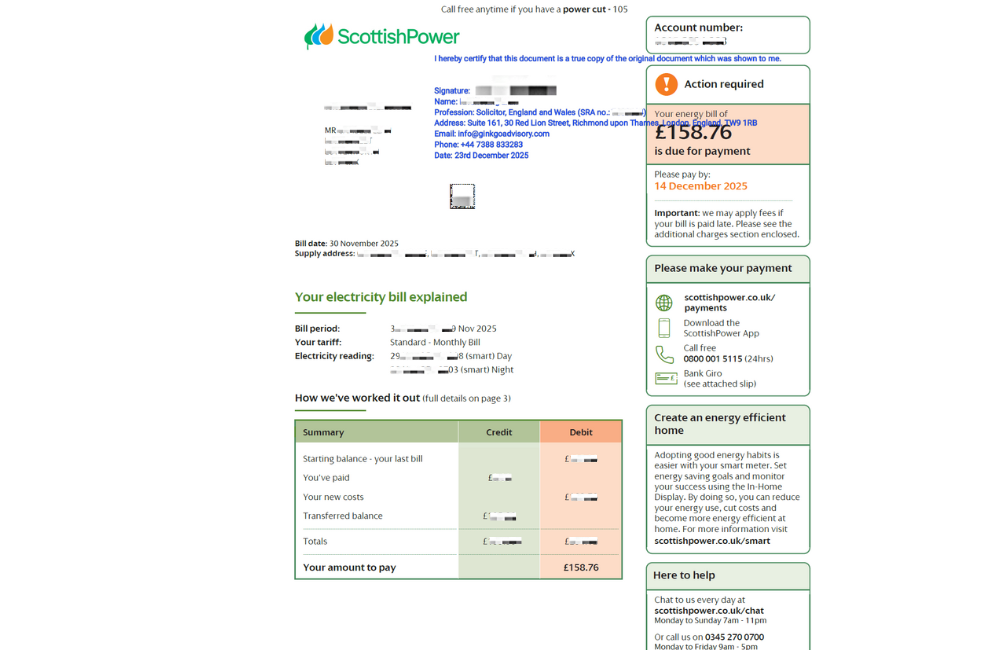

For non-photo documents (such as utility bills or bank statements), certification confirms:

- The copy is a true and accurate copy of the original

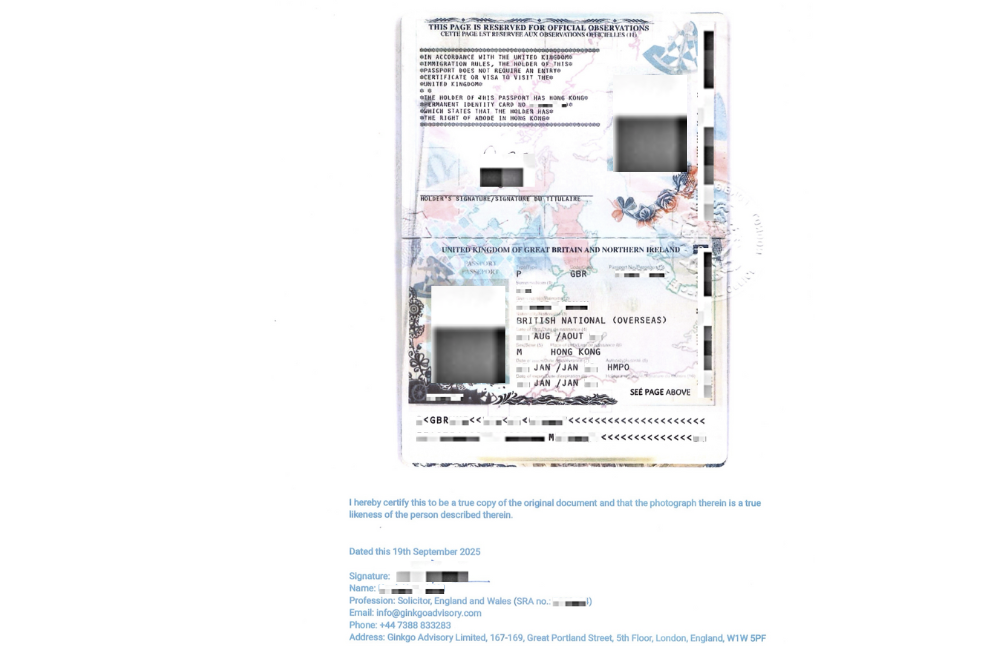

Certification must usually include:

- Signature and full name of certifier

- Professional title and business contact details

- Registration number (if applicable)

- Certification date

Why Banks and Compliance Teams Require Certified Copies

UK banks must follow strict regulatory standards under KYC, AML and financial crime prevention rules.

Certified documents help confirm:

- Identity authenticity

- Residential address verification

- Source of funds and ownership structure

- UBO transparency for companies and trusts

Institutions such as HSBC apply enhanced verification standards, especially for international or higher-risk applications.

Common Documents That Require Certification

Identification

Most commonly:

- Passport

- UK driving licence

- National identity card

- Government-issued travel documents

Proof of Address

Typically:

- Utility bills

- Council tax bills

- Bank or credit card statements

- Mortgage statements

- Government tax or benefit letters

Most institutions require address proof issued within the last 3–4 months.

Why UK Practising Solicitors Are Commonly Used

Although several professionals may certify documents, certification completed by a UK practising solicitor is widely accepted because solicitors:

- Are regulated by the Solicitors Regulation Authority (SRA)

- Follow formal identity verification standards

- Carry professional liability and compliance accountability

- Are recognised internationally for legal certification reliability

This is particularly important for banking, investment onboarding, immigration, and corporate ownership verification.

Common Reasons Certified Documents Are Rejected

In practice, rejection usually happens due to:

- Missing certification wording

- Incomplete certifier details

- Expired address documents

- Online printouts not accepted by compliance teams

- Name or address mismatch with application records

How Ginkgo Advisory Can Help

Ginkgo Advisory supports clients requiring UK document certification and compliance preparation.

Services include:

Certified Copies via UK Practising Solicitor

Suitable for:

- Bank and investment account onboarding

- KYC and AML verification

- UBO and corporate shareholder checks

- Immigration and residency applications

- Cross-border financial or legal transactions

Remote Certification Support

For overseas clients, we can coordinate:

- Video identity verification

- Document compliance screening

- Courier delivery of certified documents

When Should You Arrange Certification Early?

Early preparation is recommended if you are:

- Opening an international bank or investment account

- Setting up a company or verifying shareholding structures

- Applying for visas or residency

- Preparing cross-border property or financial transactions

Contact Us

Address

167-169 Great Portland Street, 5/F, London